Vishnu IndianMoney

Friday, October 12, 2018, 10:33 AM

Bhilai Steel Plant blast: Death toll rises to 11

Wednesday, October 10, 2018, 7:49 PM

sdfsd dsfsd fdsf sdfsd sdfds fdsf sdfds sdfds fds

Wednesday, October 10, 2018, 5:24 PM

Learn to Save, Spend, Invest & Borrow Wisely with our Youtube Channel

Endowment life plan gives you twin benefits

You have to pay a premium to avail an endowment life policy. Your life is insured for a sum of money (sum assured), depending on the premium you pay.

The endowment life policy has a maturity period. You can opt for a maturity period of 10, 20 or even 30 years .In case you (policy holder), survive the term of the policy, you get survival benefits.(maturity benefits)

An endowment life plan invests your money in fixed income securities (debt) and also in bonds so that you get fixed returns.

If you (policy holder), die soon after taking the policy, your family gets only the sum assured amounts and no bonuses. If you survive till maturity you get a maturity benefit (sum assured + all bonuses).

Guaranteed Bonus: The endowment life policy pays a guaranteed bonus (% of the sum assured), for the first 5 years of the policy.

Revisionary Bonus: This bonus is paid for the next 5 years of the policy after you get the guaranteed bonus. This bonus is paid out of the profits of the policy. (If there are profits).If there are no profits there is no revisionary bonus.

Terminal Bonus : This bonus is paid out in the final year of the endowment life policy.

You get insurance + savings benefit. You get the money you invest with returns and also a periodic bonus at the maturity of the plan.

Helps you achieve your financial goals such as education for your children and also money for your childrens marriage.

Riders give you lump sum amounts at critical times when you need money the most. They supplement your returns.

You get tax deductions on your salary, if you invest in the endowment plan. The amount you get at maturity is tax free.

You can surrender your endowment life policy only after 2 years of holding the policy. This is possible only if the endowment life policy has a premium paying term (time you pay the premium), less than 10 years. You get 30% of the premiums you have paid in the first year and second year of the policy.

If the premium paying term of the endowment life policy is more than 10 years, then you have to surrender the policy only after 3 years. You get 30% of the premiums you have paid in the first year, second year and the third year of the policy.

If you have paid premiums for at least 3 years on your endowment life policy, you have the option to convert your policy to a paid up endowment policy.

If you are dissatisfied with your endowment life policy, but do not want to surrender it, you discontinue paying premiums on the policy. Your policy continues till maturity, but your sum assured is reduced.

No bonus is given to you from the time you discontinue paying the premiums on the policy.

The premiums you pay for the endowment life plan are deducted from your taxable salary up to INR 1.5 Lakhs per year under Section 80 C of the income tax act.

The money your family (spouse and children), receive on your (policyholders) death, is tax free under Section 10(10D) of the income tax act.

You pay the premium for the endowment life policy and an additional amount for the rider. An accidental death benefit rider gives your nominee's (family/heirs), an (additional amount + policy amount), if you (policy holder), die in an accident.

A critical illness rider gives you a lump sum of money when you (policy holder) suffer a critical illness such as cancer, heart attack or a stroke.

Historically endowment policies have been the most popular policy in the world of life insurance. A pure endowment policy is also a form of financial saving, whereby if the person covered survives beyond the tenure of the policy; he gets back the sum assured with some other investment benefits. Endowment policy's maturity period varies from ten, fifteen or twenty years up to a certain age limit. Endowment Policy combines the risk cover with financial savings.

Endowment Plan= Insurance + Savings

If premium payments are discontinued at any point of time before maturity, the policy continues with a reduced sum assured proportionate to the premiums paid.

One can also surrender the policy at any time and get the surrender value, which is usually calculated as a percentage of the premiums paid excluding the first year's premium and all extra premiums. It is therefore not advisable to surrender the policy, as the amount realized will be much lower than the premiums paid.

Tax benefits: Endowment Insurance is subject to tax benefits under section 80C

To be absolutely sure of WHAT TO LOOK OUT, talk to IndianMoney.com on the phone for FREE financial consultation.

Expert Financial Advisors from IndianMoney.com would provide you unbiased, correct and up to date information so that you can make an informed financial decision.

The lump sum (Sum Assured+ All Bonuses) that is payable on the maturity date of a policy.

Yes. You can change beneficiary nominated by you at any time until the maturity date. All you need to do is to inform us about the change by completing the 'Application for Change in Policy Contract' form.

Subject to certain limits and conditions prescribed by the Income Tax Act, 1961, premiums paid to effect or to keep in force an insurance policy on the life of the assesses or on the life of the wife or husband or any child (whether minor or major) of the assessed irrespective of the status of the child, enjoys tax rebate under section 80C of the Income Tax Act 1961.

The cash value payable by the insurance company on termination of the policy contract at the desire of Policyholder but before the expiry term is known as Surrender Value.

This is a with-profit plan and participates in the profits of the Corporation's life insurance business. It gets a share of the profits in the form of bonuses. Simple Reversionary Bonuses are declared annually at the end of each financial year.

The bonus declared does not compound it, only accumulates

Money back plans are a special type of endowment plan and are also called as anticipated endowment assurance plans. Under money back plans, survival benefits are spread over the term of the policy i.e., certain percentage of sum assured is paid at regular intervals. Apart from the above, death benefit continues like an endowment plan i.e., full sum assured shall be payable on death within the term irrespective of earlier survival benefits.

Riders are additional benefits added to the base plan or policy at an extra premium. Riders/add-ons is the additional benefits, which can be added to the basic policy by paying marginal additional premium. Each company has got their own set of riders and the most common riders offered by insurers are: Term rider, Critical illness rider, Accidental death and dismemberment rider, Waiver of premium rider, Payor benefit rider To ensure you make a wise investment, call us on 080 67974000 to help you make an informed decision!

You must check and see whether or not there is availability of guarantee of return, what the lock in period is, details of premium to be paid, what would be implications of premium default, what the revival conditions are what the policy terms are, what are the charges that would be deducted, would loan be available etc.

The disclosures made in a proposal are the basis for underwriting a policy and therefore any wrong statements or disclosures can lead to denial of a claim.

In case of certain proposals, depending upon the age of entry, age at maturity, sum assured, family history and personal history, special medical reports may be necessary for consideration of a risk. E.g. if the proposer is overweight, special reports like Electro Cardiogram, Glucose Tolerance test etc could be required, while for underweight proposers, X-ray of the chest and lungs with reports could be required.

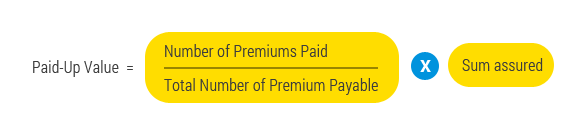

After premiums are paid for a certain defined period or beyond and if subsequent premiums are not paid, the sum assured is reduced to a proportionate sum, which bears the same ratio to the full sum assured as the number of premiums actually paid bears to the total number originally stipulated in the policy. For example, if sum assured is 1 lakh and the total number of premiums is payable is 20 (20 years policy, mode of premium is assumed yearly) and default occurs after 10 yearly premiums are paid, the policy acquires the paid up value of 50,000/-. Paid up Value = No. of Premiums Paid / No. of Premiums Payable X S.A=10/20 X 100000 = 50000/-. This means that the policy is effective as before except that from the date the 11th premium was due, the sum assured is 50,000/- instead of original 1,00,000/-. To this sum assured the bonus already vested (accrued) before the policy lapsed, is also added. Example if the bonus accrued up to the date of lapse is 35,000/-, the total paid up value is 50000 + 35000 = 85000.

Surrender Value is allowed as a percentage of this paid up value. Surrender value is calculated as per the surrender value factor, which depends on the premiums paid and elapsed duration.

If the policy conditions permit grant of loan, loan is sanctioned as a percentage of the Surrender Value.

Usually the Insurance Company will send intimation attaching the discharge voucher to the policy holder at least 2 to 3 months in advance of the date of maturity of the policy intimating the claim amount payable. The policy bond and the discharge voucher duly signed and witnessed are to be returned to the insurance company immediately so that the insurance company will be able to make payment. If the policy is assigned in favour of any other person the claim amount will be paid only to the assignee who will give the discharge.

Settlement option means the facility made available to the policy holder to receive the maturity proceeds in a defined manner (the terms and conditions are specified in advance at the inception of the contract).

The basic documents that are generally required are death certificate, claim form and policy bond, Other documents such as medical attendant's certificate, hospital certificate, employer's certificate, police inquest report, post mortem report etc could be called for, as applicable. The claim requirements are usually disclosed in the policy bond.

08 December 2010, Wednesday

What is a Credit Card? A credit card is a card entitling its holder to buy goods and services based on the holder's promise to pay for these goods and services. The issuer of the card grants a line of credit to the consumer from which the user can borrow money for payment to a merchant or a ....

04 December 2010, Saturday

What is a Savings Bank Account? As the name denotes, this account is perfect for parking your temporary savings. These accounts are one of the most popular deposits for individual accounts. These accounts provide cheque facility and a lot of flexibility for deposits and withdrawal of funds from ....

09 December 2015, Wednesday

It is the month of December. Just 22 days left for the New Year. You must have already made plans on how to celebrate the New Year. You could usher in the New Year, with a trip to Goa. Perhaps even a trip abroad. Go to New Zealand or Australia and be one of the first, to welcome the New Year. You ....

Friday, October 12, 2018, 10:33 AM

Wednesday, October 10, 2018, 7:49 PM

Wednesday, October 10, 2018, 5:24 PM

Learn to Save, Spend, Invest & Borrow Wisely with our Youtube Channel

Endowment Policy - What is an endowment policy and when should you go for it?

6 Years Ago

Should you opt for a loan against insurance policy?

6 Years Ago

Corona should not spoil our children future

6 Years Ago

Tuesday, January 9, 2018, 1:45 PM

Wednesday, July 12, 2017, 10:33 AM

Wednesday, July 12, 2017, 10:24 AM

This is to inform that Suvision Holdings Pvt Ltd ("IndianMoney.com") do not charge any fees/security deposit/advances towards outsourcing any of its activities. All stake holders are cautioned against any such fraud.