Watch: Parenting Habits That Prevent Children From Succeeding In Life

Wednesday, November 22, 2017, 1:14 PM

MTNL shares rise over 8% on merger talks with BSNL

Wednesday, March 8, 2017, 3:03 PM

Learn to Save, Spend, Invest & Borrow Wisely with our Youtube Channel

You are the sole breadwinner of the family and rising expenses eat up most of your savings. Providing your child a good education is your main duty to your children and no doubt you are saving up for this.

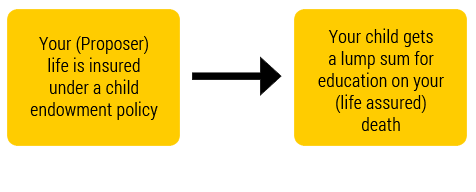

Child Endowment Plan

Child Ulip Plan

A child Ulip works in the same way as a Ulip.

A child Ulip has twin benefits

You can gift your child a childrens plan, on his first birthday. This is a gift he will always remember and cherish.

You can provide your children, with good quality education and not bother about the cost.

Child plans with waiver of premium rider, ensures your child has a good education, even in your absence.

You get tax deductions on your salary, if you invest in a child plan. The amount you get at maturity is tax free.

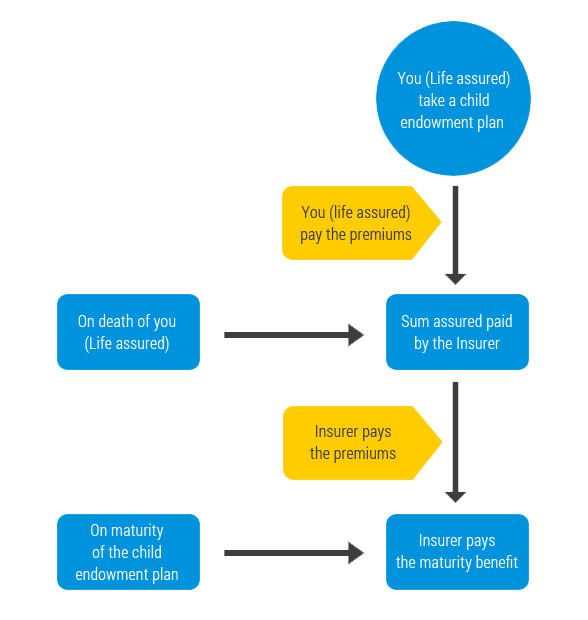

The child Ulip can be taken by you (parent), your spouse or even your parents (child's grandparents), as the proposer of the policy. The child ulip is taken on the proposer's life. (You/Spouse/Child's grandparents) and he/she becomes the life assured under the policy.

If you are the life assured of the child ulip plan, on your death a lump sum is provided to your child (or the guardian), for your child's education.

The child Ulip has a lock in of 5 years. (You must stay invested for five years).

You get a deduction under Section 80C of the Income tax act up to INR 1.5 Lakhs per year, on your taxable salary for the premiums you pay for the child ulip.

The maturity amount you get when the child ulip matures, or the death benefit your child gets on your (life assured) death, are tax free under Section 10(10D) of the income tax act.

You have to pay the premiums in a child ulip plan until the maturity of the plan or for a fixed period.

If you (life assured), die before the maturity of the plan, the child ulip pays your child (or his guardian), the death benefits (sum assured).

What makes a child ulip plan with a waiver of premium rider unique is on your (life assured) death, all future premiums are paid by the Insurer (Life Insurance Company).

On maturity of the plan (when your child is 18-25 years of age), the child gets a maturity amount which is the fund value of the plan.

On your (life assured) death the sum assured is paid.

On the maturity of the policy the fund value is paid.

These days, insurance policies play a key role in the financial planning activity revolving around children. Insurance companies offer children plans which help parents fulfill their most important financial responsibility towards their children even in their absence, and that is financing their higher education.

Basically Children Insurance plans are there to provide better education to your child at the right time and secure the child's future in case of any uncertainties like death, disability, loss of job etc

Children plans are offered by both public and private insurance companies. Although the policies of different companies vary in the details, most of them have some common features like:

Aiming at securing the educational/marriage needs of the child

Term period of 10-25 years

Most have no maximum sum limit

Children Insurance plans have tax benefits

Tax benefits: Children insurance plans qualifies for tax benefits under Section 80C

To be absolutely sure of WHAT TO LOOK OUT, talk to IndianMoney.com on the phone for FREE financial consultation.

Expert Financial Advisors from IndianMoney.com would provide you unbiased, correct and up to date information so that you can make an informed financial decision.

There may be various expenses which you need to incur for children in your future for various events like education, marriage etc. Children insurance policy will help you to accumulate the required wealth in future and solve your financial problems.

The child's parent or legal guardian or grandparent can buy the child life insurance.

Yes, the proceeds from a life insurance policy are tax-free on maturity

Ideal time to buy a child plan is when the child is still young and not reached teens. This allows enough time to build the corpus you have planned for, with considerably lower premiums. If the child is already in teens, you hardly get 3 to 5 years to build the same corpus so the premiums are quite high.

Most child plans come with the payer benefit or the waiver of premium benefit. So, if the proposer dies, the insurance company takes care of all the future premiums of the child's policy. The child is also entitled to a sum assured along with it. Each insurance company has this benefit in exact or similar form depending on the company policy. Generally payer benefit is inbuilt in the child plan but if not, it can be taken as a rider with nominal premium. To learn more about riders that suit your children insurance plan, call us on 080 67974000.

The traditional child insurance policy has guaranteed returns. It has a fixed maturity amount that is given to the insured at a specific age. It can be of two types: i. Child endowment policy: In this case the child receives a fixed maturity amount in lump sum at the maturity of the plan. ii. Child money back policy: Here, the child receives fixed portions of the sum assured at pre determined regular intervals. Finally on the policy maturity date, the child receives balance maturity amount.

It depends totally on your ability to bear the risks and the ups and downs of the market. Traditional plans are risk free. The returns may be on the lower side but are guaranteed. Unit linked child pans are market based. Returns depend on the type of funds and market conditions at the time of maturity.

Guaranteed addition is a percentage of sum assured which the insurance companies guarantee. It is added to the basic sum assured or the maturity amount and is payable at the time of policy maturity.

Loyalty addition is a kind of bonus amount declared by the insurance company from time to time depending upon the company performance. It is a non guaranteed amount calculated on the sum assured. This amount is added to the maturity amount and is payable to you on the maturity date.

The insurance companies issue a discharge or a claims form some time before the maturity date. You need to fill up the form and send it to the insurance company along with documents as mentioned in the form. The amount is then sent to you or deposited in your account.

Yes, death benefit can be denied in some cases: i. Death benefit is not payable in case the insured commits suicide within 12 months of taking the policy or within 2 months of reinstating the lapsed policy. ii. If the policy has lapsed due to nonpayment of premiums, death benefit is not payable.

21 January 2016, Thursday

You have just got your first job in a reputed Company. Offer letter in hand, you rush home to show it to your parents. The offer letter is the first sign that you are truly independent. You want to show off your independence. Is there a better way than buying your own home? You need to avail a ho ....

08 December 2010, Wednesday

What is a Credit Card? A credit card is a card entitling its holder to buy goods and services based on the holder's promise to pay for these goods and services. The issuer of the card grants a line of credit to the consumer from which the user can borrow money for payment to a merchant or a ....

04 December 2010, Saturday

What is a Savings Bank Account? As the name denotes, this account is perfect for parking your temporary savings. These accounts are one of the most popular deposits for individual accounts. These accounts provide cheque facility and a lot of flexibility for deposits and withdrawal of funds from ....

Wednesday, November 22, 2017, 1:14 PM

Wednesday, March 8, 2017, 3:03 PM

Learn to Save, Spend, Invest & Borrow Wisely with our Youtube Channel

What is a bridge loan?

6 Years Ago

ಸಿ ಎಸ್ ಸುಧೀರ್ ರವರ 19ನೇ ಯಶಸ್ವಿ ಫೈನಾನ್ಶಿಯಲ್ ಫ್ರೀಡಂ ವರ್ಕ್ ಶಾಪ್ ಹೇಗಿತ್ತು?

6 Years Ago

How to Claim Insurance in Telugu - Tips to Claim Insurance After Death | Money Doctor Show | TV5

6 Years Ago

This is to inform that Suvision Holdings Pvt Ltd ("IndianMoney.com") do not charge any fees/security deposit/advances towards outsourcing any of its activities. All stake holders are cautioned against any such fraud.